DonorDock is a US-based company, and we support US-based nonprofits (or nonprofits with a US presence)

For full access to all the features within DonorDock, your organization must be a registered 501(c)(3) (or similar tax-exempt classification) with the United States Internal Revenue Service (IRS).

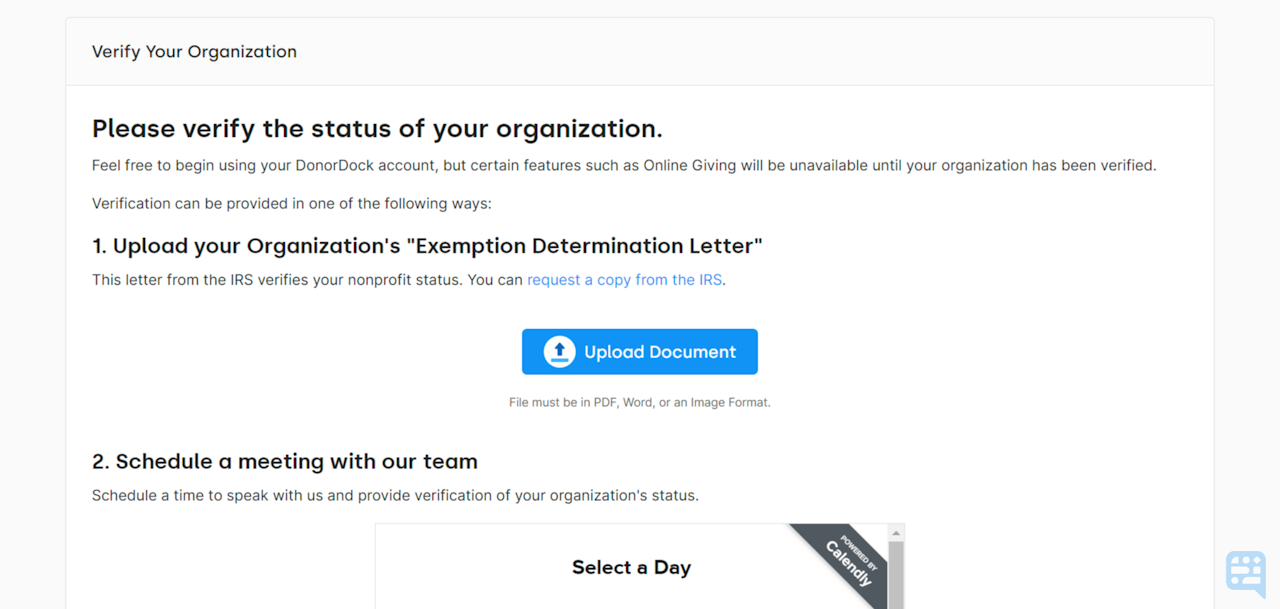

During your initial signup and registration with DonorDock, you will be asked to provide a Tax Exemption Letter (also known as Exemption Determination Letter) to DonorDock. If you do not have the Tax Exception Letter available at the time of signup, you have the option to upload the document underneath Organization Settings.

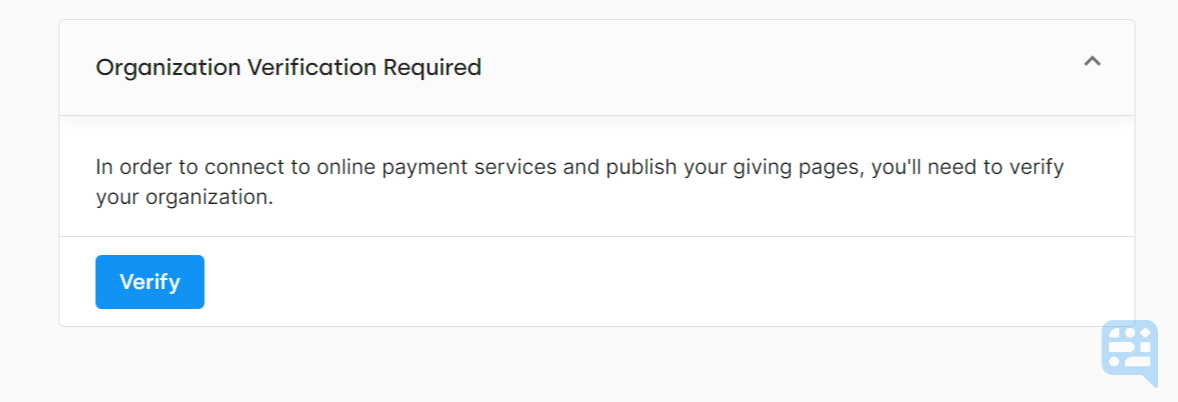

Until your organization has been successfully verified, you will have limited access to Marketing and Online Giving features in DonorDock.

Features that will be locked until verification include, but are not limited to:

Requesting an SMS number for Text-to-Donate

Publishing a Giving Page

Publishing a Sign Up Form

Scheduling or Sending Marketing emails

To Upload your Tax Exempt Letter under Organization Settings

Once logged into DonorDock, click the Settings Menu icon (grid icon)

Select the option to Verify Organization

Click the blue button Upload Document

Select your Tax Exemption Letter and upload to DonorDock

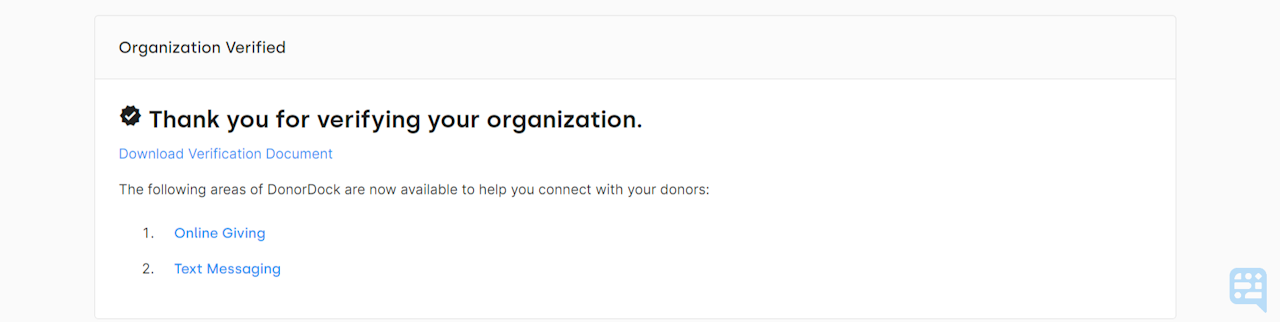

You will receive a message that we have received your document and are now reviewing. Once approved, you will have full access to all features in your DonorDock subscription level.